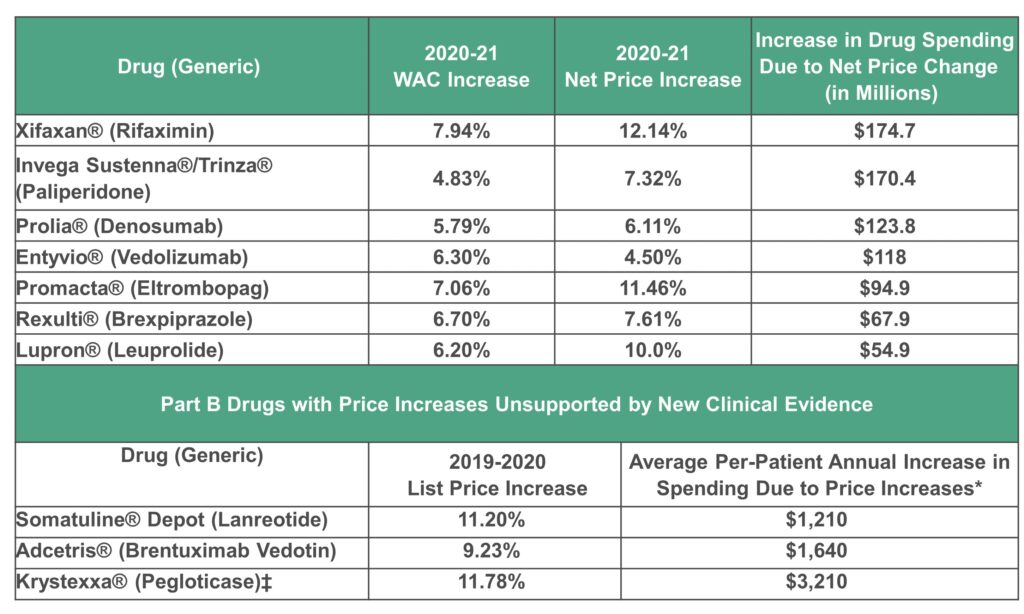

— Seven out of 10 high-expenditure drugs had substantial 2021 net price increases that were not supported by new clinical evidence; these increases accounted for $805 million in additional costs over one year —

— Three Medicare Part B drugs with high list price increases in 2020 lacked adequate supporting new evidence, directly raising annual out-of-pocket expenses for Medicare patients by up to $3,200 per year —

BOSTON, December 6, 2022 – The Institute for Clinical and Economic Review (ICER) today published its latest report on Unsupported Price Increases (UPI) of prescription drugs in the United States. Among the top 10 drugs with net price increases in 2021 that had substantial effects on US spending, ICER determined that seven lacked adequate new evidence to support any price increase.

For this year’s report, an additional three therapies were identified that had the highest increases in total population-based spending by the Centers for Medicare and Medicaid Services (CMS) from 2019 to 2020 due to increases in list prices. We needed to examine this earlier time period because of the delay in public availability of data from CMS. The decision to add a review of therapies based solely on their increase in list pricing reflected concerns ICER heard from patient groups that list price changes in Medicare Part B often have large effects on patients even if net prices do not change significantly.

“Increases in drug prices frequently occur without important new evidence,” said David Rind, MD, ICER’s Chief Medical Officer. “There remain many high-cost brand drugs that continue to experience significant annual price hikes, even after accounting for their rebates. List prices also continue to increase, and this can present real hardships to patients who must pay deductibles or coinsurance. For this reason, we examined Medicare Part B drugs, recognizing that many patients may be responsible for up to 20% of the list price. As new legislation will limit drug-price increases for Medicare in future years, there may remain situations in which increases to list and/or net pricing will have important ramifications for patients and payers. Our UPI reports will continue to provide an explicit and independent approach to evaluate whether price increases are supported by new evidence so that the public and policymakers can have a basis for further action where needed. ”

Methodology and Key Findings

Consistent with our protocol announced in April 2022, ICER identified a list of prescription drugs that met each of the following criteria:

- Were among the top 250 drugs by 2020 US sales revenue;

- Had WAC (list) price increases that exceeded the consumer price index plus 2%;

- Even after rebates and other concessions, had net price increases that placed them at the top of the list of drugs; and

- After net price increases were vetted with manufacturers, were found to be the top 10 drugs whose price increases — as opposed to volume increases — contributed to the largest increase in US spending.

This selection process produced a total of 10 prescription drugs, for which ICER then determined whether, during 2021, there was any new moderate or high-quality evidence that these treatments provide a substantial improvement in net health benefit beyond what was previously known. Following consideration of input from manufacturers and a systematic review of evidence available in published studies, ICER determined that seven of the 10 drugs lacked adequate evidence to support a claim of additional clinical benefit. These seven therapies, in order of the impact of their net price increases on US drug spending, are displayed in the following table:

WAC: wholesale acquisition cost

*Annual increase per-patient spending due to 20% coinsurance; for patients without supplemental insurance, this annual increase is out-of-pocket expenses.

‡Pegloticase had been previously assessed for the 2019 to 2020 time period in the prior UPI Report and was found to have a net price increase unsupported by new clinical evidence. As such, under the UPI Protocol, pegloticase is identified as having had an important list price increase for this time period but is not re-reviewed for supporting evidence.

The three drugs assessed that did have important new clinical evidence were Cosentyx® (Secukinumab), Tremfya® (Guselkumab), and Jakafi® (Ruxolitinib). Importantly, however, ICER’s determination that new evidence exists for these three treatments should not be interpreted to mean that the new evidence justifies the level of price increase; a full cost-effectiveness assessment was not conducted.

Comparison to Previous Unsupported Price Increases

In October 2019, ICER published our first UPI report, which identified seven specific drugs that experienced unsupported price increases that cost American insurers and patients an additional $4.8 billion across the two-year period of 2017 and 2018. In January 2021, ICER published our second UPI report, this time covering only the single year of 2019, identifying another seven unsupported price increases that cost Americans an additional $1.2 billion in annual drug spend. In November 2021, ICER published our third UPI report covering the year of 2020, and found that unsupported price increases on seven treatments, even after pharmaceutical rebates and other concessions, cost the US health system an additional $1.67 billion beyond what would have been spent if their net prices had remained flat.

About ICER

The Institute for Clinical and Economic Review (ICER) is an independent non-profit research institute that produces reports analyzing the evidence on the effectiveness and value of drugs and other medical services. ICER’s reports include evidence-based calculations of prices for new drugs that accurately reflect the degree of improvement expected in long-term patient outcomes, while also highlighting price levels that might contribute to unaffordable short-term cost growth for the overall health care system. For more information about ICER, please visit ICER’s website.